Debt to Equity Ratio Formula Analysis Example

However, an ideal D/E ratio varies depending on the nature of the business and its industry because there are some industries that are more capital-intensive than others. Current assets include cash, inventory, accounts receivable, and other current assets that can be liquidated or converted into cash in less than a year. For example, Company A has quick assets of $20,000 and current liabilities of $18,000. Company B has quick assets of $17,000 and current liabilities of $22,000. The quick ratio is also a more conservative estimate of how liquid a company is and is considered to be a true indicator of short-term cash capabilities. Quick assets are those most liquid current assets that can quickly be converted into cash.

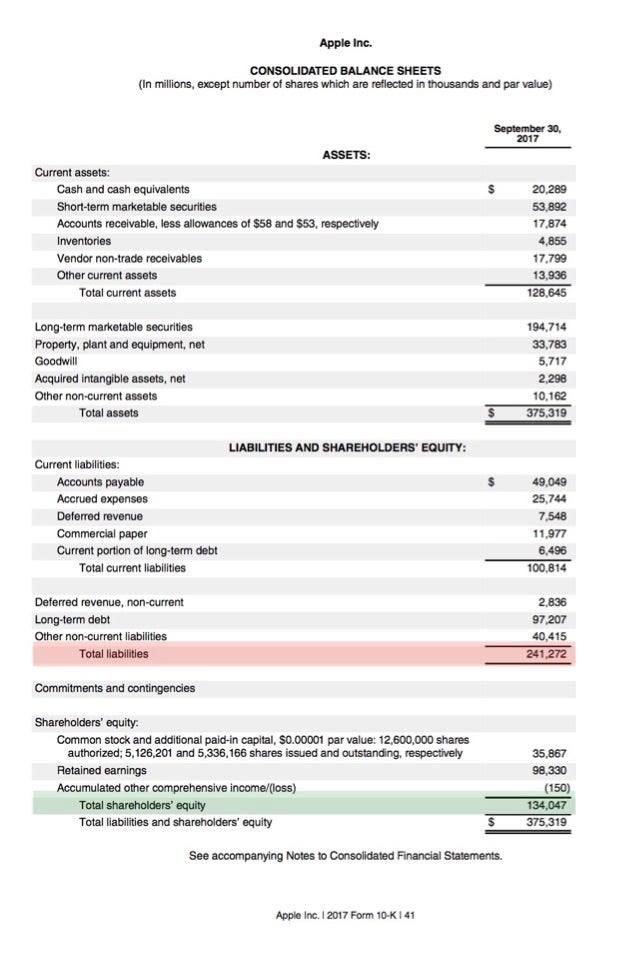

Example D/E ratio calculation

The debt to equity ratio is a financial, liquidity ratio that compares a company’s total debt to total equity. The debt to equity ratio shows the percentage of company financing that comes from creditors and investors. A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders). A debt to equity ratio analysis shows the proportion of debt and shareholders’ equity in the business’s capital structure.

What Does It Mean for a Debt-to-Equity Ratio to Be Negative?

This debt to equity calculator helps you to calculate the debt-to-equity ratio, otherwise known as the D/E ratio. This metric weighs the overall debt against the stockholders’ equity and indicates the level of risk in financing your company. The debt-to-equity ratio divides total liabilities by total shareholders’ equity, revealing the amount of leverage a company is using to finance its operations. An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations. However, industries may have an increase in the D/E ratio due to the nature of their business.

Current Ratio

The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than its own resources. The Debt to Equity Ratio is a financial metric used to evaluate a company’s financial leverage by comparing its total liabilities (debt) to the shareholders’ equity. It shows how much of the company’s operations are financed by debt relative to the money owners have invested. In simpler terms, this ratio tells us how much debt is being used to finance the company’s assets relative to the value of shareholders’ equity. The financial health of a business is assessed by various stakeholders – investors, lenders, market analysts, etc., to make informed decisions.

Impact on Investment Decisions

To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations. In other industries, such as IT, which don’t require much capital, a high debt to equity ratio is a sign of great risk, and therefore, a much lower debt to equity ratio is more preferable. Total equity, on the other hand, refers to the total amount that investors have invested into the company, plus all its earnings, less it’s liabilities. Please note that what is considered a “high” or “low” D/E ratio can vary widely depending on the industry. Some industries, like financial services, have naturally higher ratios, while others, like technology companies, may have naturally lower ones.

Calculation of Debt To Equity Ratio: Example 3

- Investors who want to take a more hands-on approach to investing, choosing individual stocks, may take a look at the debt-to-equity ratio to help determine whether a company is a risky bet.

- Investors can use the debt-to-equity ratio to help determine potential risk before they buy a stock.

- The debt-to-equity ratio is important because it gauges how healthy the relationship in the business is between debt and equity, and expresses the capacity of a business to raise financing for growth.

- A long-term debt-to-equity ratio is a ratio that expresses the relationship between a company’s long-term debts and its equity.

- But it can also show investors that business owners aren’t realising their company’s full potential because they’re not borrowing to grow.

A high debt-to-equity ratio suggests that a company relies heavily on debt financing and may have higher financial risk. This means that for every dollar of equity, Company A has two dollars of debt. This might be concerning for investors and creditors, as it indicates a high level of leverage and potential financial risk. Debt to Equity Ratio is calculated by dividing the company’s shareholder equity by the total debt, thereby reflecting the overall leverage of the company and thus its capacity to raise more debt. In general, a high debt-to-equity ratio indicates that a company may not be able to generate enough cash to meet its debt obligations. However, a low debt-to-equity ratio can also indicate that a company is not taking advantage of the increased profits that financial leverage can bring.

A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable. Different sectors have varying norms, and it’s essential to compare against industry averages. Inflation can erode the real value of debt, potentially making a company appear less leveraged annual tax planning resources for businesses and individuals than it actually is. It’s crucial to consider the economic environment when interpreting the ratio. While it depends on the industry, a D/E ratio below 1 is often seen as favorable. Ratios above 2 could signal that the company is heavily leveraged and might be at risk in economic downturns.

For example, a prospective mortgage borrower is more likely to be able to continue making payments during a period of extended unemployment if they have more assets than debt. This is also true for an individual applying for a small business loan or a line of credit. Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. Many companies borrow money to maintain business operations — making it a typical practice for many businesses. For companies with steady and consistent cash flow, repaying debt happens rapidly. Also, because they repay debt quickly, these businesses will likely have solid credit, which allows them to borrow inexpensively from lenders. While acceptable D/E ratios vary by industry, investors can still use this ratio to identify companies in which they want to invest. First, however, it’s essential to understand the scope of the industry to fully grasp how the debt-to-equity ratio plays a role in assessing the company’s risk.

For example, manufacturing companies tend to have a ratio in the range of 2–5. This is because the industry is capital-intensive, requiring a lot of debt financing to run. Restoration Hardware’s cash flow from operating activities has consistently grown over the past three years, suggesting the debt is being put to work and is driving results. Additionally, the growing cash flow indicates that the company will be able to service its debt level. As an example, the furnishings company Ethan Allen (ETD) is a competitor to Restoration Hardware.