Debt-to-Equity D E Ratio: Calculation, Importance & Limitations

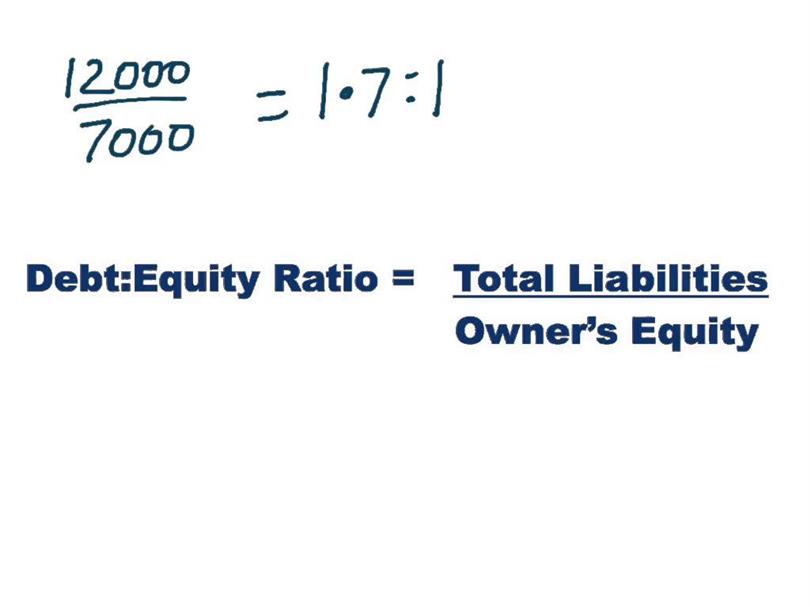

Whether you’re an investor deciding where to put your money or a business owner trying to improve your operations, this number is crucial. The debt-to-equity ratio is one of the most commonly used leverage ratios. The debt-to-equity ratio is calculated by dividing total liabilities by shareholders’ equity or capital.

Why Companies Use Debt (Debt Financing)

A debt-to-equity ratio of 1.5 shows that the company uses slightly more debt than equity to stimulate growth. For every dollar in shareholders’ equity, the company owes $1.50 to creditors. Your company owes a total of $350,000 in bank loan repayments, investor payments, etc. The interest paid on debt also is typically tax-deductible for the company, while equity capital is not. Keep reading to learn more about D/E and see the debt-to-equity ratio formula.

- Therefore, companies with high debt-to-equity ratios may not be able to attract additional debt capital.

- Retained earnings, also known as retained surplus or accumulated earnings, are a component of shareholder equity and should be included in the denominator of the debt-to-equity ratio.

- This ratio also helps in comparing companies within the same industry, offering a benchmark to understand how a company’s leverage stacks up against its peers.

- For instance, a company with $200,000 in cash and marketable securities, and $50,000 in liabilities, has a cash ratio of 4.00.

- It’s also helpful to analyze the trends of the company’s cash flow from year to year.

How do companies improve their debt-to-equity ratio?

Our company now has $500,000 in liabilities and still has $600,000 in shareholders’ equity. Total assets have increased to $1,100,000 due to the additional cash received from the loan. Understanding the average Debt to Equity ratio in your industry helps contextualize your company’s financial standing. This comparison can inform strategic decisions regarding financing and growth. Companies can manage their Debt to Equity ratio by controlling debt levels and increasing equity through retained earnings or issuing new shares.

Ask a Financial Professional Any Question

The nature of the baking business is to take customer deposits, which are liabilities, on the company’s balance sheet. Like the D/E ratio, all other gearing ratios must be examined in the context of the company’s industry and competitors. Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt. If the D/E ratio of a company is negative, it means the liabilities are greater than the assets. It’s useful to compare ratios between companies in the same industry, and you should also have a sense of the median or average D/E ratio for the company’s industry as a whole.

Strategic management of this ratio is crucial for long-term financial health. We have the debt to asset ratio calculator (especially useful for companies) and the debt to income ratio calculator (used for personal financial purposes). When evaluating a company’s debt-to-equity (D/E) ratio, it’s crucial to take into account the industry in which the company operates. Different industries have varying capital requirements and growth patterns, meaning that a D/E ratio that is typical in one sector might be alarming in another.

Interpreting Debt-To-Equity Ratios:

Determining whether a company’s ratio is good or bad means considering other factors in conjunction with the ratio. It is important to note that the D/E ratio is one of the ratios that should not be looked at in isolation but with other ratios and performance indicators to give a holistic view of the company. A good D/E ratio of one industry may be a bad ratio in another and 18 best hair growth products 2021 according to dermatologists vice versa. In addition, the reluctance to raise debt can cause the company to miss out on growth opportunities to fund expansion plans, as well as not benefit from the “tax shield” from interest expense. Depending on the industry they were in and the D/E ratio of competitors, this may or may not be a significant difference, but it’s an important perspective to keep in mind.

The D/E ratio can be skewed by factors like retained earnings or losses, intangible assets, and pension plan adjustments. Therefore, it’s often necessary to conduct additional analysis to accurately assess how much a company depends on debt. The debt-to-equity ratio divides total liabilities by total shareholders’ equity, revealing the amount of leverage a company is using to finance its operations. Companies can improve their D/E ratio by using cash from their operations to pay their debts or sell non-essential assets to raise cash. They can also issue equity to raise capital and reduce their debt obligations.

Inflation can erode the real value of debt, potentially making a company appear less leveraged than it actually is. It’s crucial to consider the economic environment when interpreting the ratio. Different sectors have varying norms, and it’s essential to compare against industry averages. While it depends on the industry, a D/E ratio below 1 is often seen as favorable. Ratios above 2 could signal that the company is heavily leveraged and might be at risk in economic downturns. However, in this situation, the company is not putting all that cash to work.

On the other hand, when a company sells equity, it gives up a portion of its ownership stake in the business. The investor will then participate in the company’s profits (or losses) and will expect to receive a return on their investment for as long as they hold the stock. The debt capital is given by the lender, who only receives the repayment of capital plus interest. Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders.

Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio. This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts (REITs). As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital. Companies in the consumer staples sector tend to have high D/E ratios for similar reasons.

However, these balance sheet items might include elements that are not traditionally classified as debt or equity, such as loans or assets. The debt-to-equity ratio is one of the most important financial ratios that companies use to assess their financial health. It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity. Taking a broader view of a company and understanding the industry its in and how it operates can help to correctly interpret its D/E ratio. For example, utility companies might be required to use leverage to purchase costly assets to maintain business operations. But utility companies have steady inflows of cash, and for that reason having a higher D/E may not spell higher risk.